Covid-19: Expansion of vaccine deliveries worldwide

Manufacturers of licensed covid-19 vaccines continue to expand production capacity - partly in their own plants and partly with the help of production partners and licensees.

Huge expansion of production capacity

Global vaccine distribution and the role of patents

In a guest article in the ÄrzteZeitung of Feb. 23rd, 2022, vfa President Han Steutel explains how global vaccine distribution can be improved. For him, patent revocations are not suitable for this purpose. The topic is also discussed in a report by Deutschlandfunk radio on July 1st, 2022, for which vfa research spokesman Dr. Rolf Hömke was interviewed, among others. The topic was already comprehensively discussed on on July 1st, 2021 in the Max Planck Forum "Vaccine for all! What can be done?"

was discussed, among others with Prof. Dr. Jochen Maas from Sanofi. Here, Prof. Dr. Reto Hilty of the Max Planck Institute for Innovation and Competition explained how patent law must be balanced to promote new developments. Globally, according to "Our World in Data," a data source operated by Oxford University, some 11.9 billion doses of Covid-19 vaccine have been vaccinated to date (June 9th, 2022), reaching 65.9% of the world's population.

On the one hand, this shows the enormous increase in vaccine production that has been achieved in the second half of 2021; because by the beginning of June 2021, according to Agence France Press, only slightly more than 2 billion vaccine doses had been vaccinated. The increase is even more impressive when compared to the production capacity for vaccines against the 30 or so other vaccine-preventable diseases: According to WHO, in 2019, just before the pandemic, it totaled only 5.5 billion doses worldwide. Since then, that production has continued; and the production of Covid-19 vaccine doses has been in addition to, not at the expense of, that amount.

On the other hand, "Our World in Data" also documents that progress in recent months has been much slower than before (currently only 5.5 million doses of vaccine are being administered per day); and this despite the fact that far more vaccine has long been available than is being called for. Even a few months ago, there was a surplus of doses produced but not yet used.

Vaccine stockpiles in selected countries. LMICs = Lower Middle Income Countries; LICs = Least Income Countries (Source: EFPIA based on Airfinity

This can also be seen in the request by the African Center for Disease Control (CDC) to postpone the delivery of donated vaccine until the second half of 2022, if possible, because it cannot be vaccinated fast enough at the moment.

Manufacturers in India and South Africa were therefore forced to reduce or foreseeably discontinue production due to lack of demand.

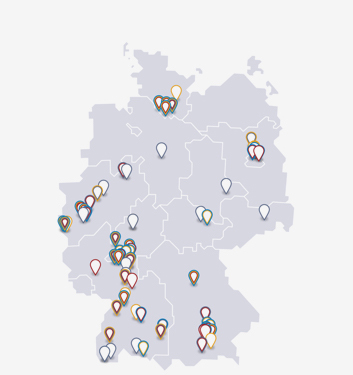

Vaccine supplies for Germany

In Germany, as in all EU countries except Hungary and Slovakia, vaccination is carried out exclusively with Covid 19 vaccines that have received EU approval via the EMA. The German government provides information on the quantities of vaccine received and the status of coronavirus vaccination in Germany on its vaccination dashboard.

It shows that the amount of vaccine doses delivered per week was particularly large in the second and fourth quarters of 2021. Currently, Germany sources vaccines from BioNTech/Pfizer, Moderna, Janssen and Novavax (the supply contract with AstraZeneca has expired and has not been renewed). Valneva and Sanofi are expected to join as suppliers later in the year.

Production networks continue to grow

The originator companies themselves have the greatest interest in ensuring that as much of their Covid 19 vaccines as possible can be delivered. That is why they are continuing to expand production capacity, which began in parallel with the development programs for their vaccines, despite the slump in demand. They are doing this partly in their own plants, where they are bringing in additional production lines; partly they are expanding their network to include further production partners and licensees. After retooling or expanding their facilities and training their personnel, these partners could or can supply components for the vaccine or take over certain manufacturing steps in parallel with the original manufacturer. Licensees are also usually able to manufacture and market the respective vaccine completely independently.

The example of BioNTech and Pfizer illustrates how companies have expanded their production networks step by step and are still doing so:

| Date of announcement | Company; Location | Function in the production of the BioNTech/Pfizer vaccine |

| May 5th, 2020 | BioNTech; Mainz (Rhineland-Palatinate) | R&D, Production |

| May 5th, 2020 | Pfizer; Puurs (Belgium) | Production |

| May 5th, 2020 | Pfizer; Kalamazoo, Andover, Chesterfield (all USA) | Production |

| Sept. 2nd, 2020 | Polymun; Vienna (Austria) | Formulation |

| Sept. 10th, 2020 | Dermapharm; Brehna (Saxony-Anhalt, Germany) | since October 2020 Formulation and filling |

| Sept. 14th, 2020 | Siegfried; Hameln (Lower Saxony) | since mid-June 2021 Filling |

| Sept. 17th, 2020 | BioNTech; Marburg (Hesse) | Production(since February) |

| Oct. 7th, 2020 | Rentschler Biopharma; Laupheim (Baden-Württemberg, Germany) | Production steps mRNA purification |

| Nov. 18th, 2021 | Delpharm; Saint-Rémy-sur-Avre (Normandy, France) | since August 2021 Filling |

| Jan. 6th, 2021 | Dermapharm; Brehna (Saxony-Anhalt, Germany) | Capacity doubling for formulation and filling |

| Jan. 13th, 2021 | Baxter BioPharma Solutions; Halle (Westphalia, Germany) | Sterile manufacturing services (since February 2021) |

| Jan. 14th, 2021 | Allergopharma; Reinbek (Schleswig-Holstein) | vaccine formulation(since April 30th, 2021) |

| Jan. 15th, 2021 | Pfizer; Puurs (Belgium) | Rebuild for more production capacity |

| Jan. 27th, 2021 | Sanofi; Frankfurt a.M. | from summer 2021 Filling |

| Jan. 29th, 2021 | Novartis; Stein in Aargau (Switzerland) | since end of Q2 Filling |

| Feb. 1st, 2021 | Rentschler Biopharma; Laupheim (Baden-Württemberg, Germany) | Expansion of capacity for mRNA purification manufacturing step for BioNTech/Pfizer |

| Feb. 5th, 2021 | Merck; Darmstadt (Hesse) | Accelerated supply of lipids needed for BioNTech/Pfizer vaccine |

| Feb. 11th, 2021 | Evonik; Hanau and Dossenheim (Germany) | Expansion of lipid production for BioNTech/Pfizer vaccine |

| Mar. 5th, 2021 | Polymun; Klosterneuburg (Austria) | Expansion of capacity for production of lipid nanoparticles for BioNTech/Pfizer vaccine |

| May 10th, 2021 | BioNTech; Singapore | future production, after construction of a production plant |

| May 17th, 2021 | Biomay (Austria) | future supply of plasmids for mRNA production |

| May 19th, 2021 | Pfizer; Grange Castle near Dublin (Ireland) | future production |

| June 1st, 2021 | Pfizer; Puurs (Belgium) | Expansion of production |

| July 21st, 2021 | Lipoid; Ludwigshafen a. Rh. (Germany) | Expansion of supply of certain lipids for formulation |

| July 21st, 2021 | BioVac; Cape Town (South Africa) | Future participation in BioNTech/Pfizer production network from early 2022 to produce vaccine for the African Union (starting from active ingredient supplied from Europe) |

| Aug. 24th, 2021 | BioNTech, Marburg (Germany) | Expansion of production capacity |

| Aug. 26th, 2021 | Eurofarma; Sao Paulo (Brazil) | Future participation in BioNTech/Pfizer production network from early 2022 to produce vaccine for South America (starting from precursor supplied from the USA) |

| Oct. 18th, 2021 | Patheon Italia; Monza (Italy) | Production of finished vaccine |

| Oct. 18th, 2021 | Catalent Anagni; Anagni (Italy) | Production of finished vaccine |

| Oct. 21st, 2021 | Novartis; Ljubljana (Slovenia) | in the course of 2022: filling of finished vaccine |

| Dec. 10th, 2021 | Novartis; Kundl (Austria) | Production of plasmids to be supplied for mRNA production |

| Dec. 16th, 2021 | Wyeth Pharmaceuticals (subsidiary of Pfizer); Andover, Massachusetts (USA) | Expansion of vaccine production |

Source: Press releases of the companies mentioned and the EMA; media reports; information provided by the companies.

Upcoming suppliers

For information on which vaccines may still contribute to global supply in the future, see "Vaccines to Protect Against Coronavirus Infection Covid-19."

Similarly, other companies have established networks for the production of their vaccines or have themselves granted licenses to other companies that have the necessary equipment and qualified personnel to do so. In each case, these companies receive comprehensive training from the original company.

Collaborations are the way to rapidly expand supplies for Corona vaccines

By contrast, the idea of contracting out the production of vaccines to any other pharmaceutical company by means of patent cancellation and compulsory licenses does not promise a rapid expansion of production capacities. After all, vaccine production is one of the most demanding tasks in drug manufacturing. Every detail is important to ensure that the vaccines are effective and well tolerated.

Only with the help of the original manufacturer can another company be quickly put in a position to participate in production. Therefore, cooperations are the conclusive way to rapidly expand production volumes.

Voluntary licensing and production collaborations of originator companies with partner companies for Covid-19 vaccines (Source: EFPIA based on Airfinity).

Licensees and production partners for vaccines from European, US or Chinese manufacturers exist, for example, in Asia, South America and Africa:

- Serum Institute of India under license from Oxford/AstraZeneca and Novavax.

- SK Bioscience (South Korea) with license from Novavax.

- Fiocruz (Brazil) under license from AstraZeneca.

- Aspen (South Africa) licensed from Janssen (USA) to supply African countries.

- Vacsera (Egypt) with license from Sinovac (China).

- Minapharm (Egypt) with license from Russian Direct Investment Fund (Russia) for production of Sputnik V.

- Sothema (Morocco) under license from Sinovac (China).

- Saidal (Algeria) under a joint venture with Sinovac (China).

In addition, several European and U.S. companies have signed agreements with African companies with the aim of jointly building production capacity for Covid 19 vaccines:

- BioNTech and Pfizer have been working with Biovac in South Africa since an announcement in July 2021 on a technology transfer that will gradually allow the company to carry out full production of mRNA vaccine against Covid-19 itself. The milestone goal is for Biovac to begin filling European-produced vaccine batches for Africa in 2022. Upstream production steps could then also take place in Africa by four years from now, if all goes according to plan.

- BioNTech also plans to begin construction of an mRNA vaccine manufacturing facility in Africa in mid-2022 (location not yet announced), which will initially be operated by the company itself but will then be handed over to local partners. Partners in the project include the Republic of Rwanda and the Institut Pasteur de Dakar in Senegal. Newly developed modular mRNA production facilities are to play a role.

- The Belgian company Unizima (a subsidiary of Univercells) is also collaborating with the Pasteur Institute in Dakar, Senegal, in the MADIBA project to establish a vaccine production facility. A plant in Senegal is expected to be ready for production during 2022. The MADIBA project is also supported by the Coalition of Epidemic Preparedness Innovations (CEPI).

- U.S.-based Dyadic International also announced a collaboration with South Africa's Rubic Consortium in July 2021. Under the agreement, the Consortium will be equipped with Dyadic's cell culture technology for the production of protein-based Covid-19 vaccines.

- Moderna announced in October 2021 that it plans to build an mRNA vaccine plant in Africa. It would then produce Covid-19 vaccine as well as other vaccines. Currently, Moderna said at the time, it was searching across countries for a suitable site.

- NantWorks, the parent company of ImmunityBio (a partner in a Covid-19 vaccine project), opened the Nant-SA Vaccine Manufacturing Campus in Brackenfel, South Africa, in January 2022 and will continue to expand it. In the future, it will be used, among other things, to produce an mRNA vaccine that incorporates the nucleocapsid protein in addition to the spike protein.

- Moderna signed a memorandum of understanding with Kenya in March 2022 to establish a factory for mRNA vaccine. Adium Pharma is Moderna's logistics partner for the supply of 18 African countries.

Covid 19 vaccine production methods: challenging and diverse

The production method for the various types of vaccines already approved or in development against Covid-19 differs significantly. In most cases, it also differs significantly from the production method for the usual vaccines against other diseases recommended in Germany, which are produced directly from killed or attenuated pathogens.

For example, some of the Covid-19 vaccines are based on genetically engineered spike protein from the SARS-CoV-2 virus. Physicians call them subunit vaccines. In one case, their production uses a culture of insect cells in nutrient medium that have been genetically engineered to produce the protein of interest. This protein must then be purified from all remnants of the insect cells and the nutrient medium. Only then can it be processed together with an emulsion of adjuvants to produce the finished vaccine. The adjuvants serve to strengthen the immune response in the vaccinated persons. The finished vaccine is finally filled into sterile glass containers.

Vector virus vaccines are produced in a completely different way. They require large cell cultures containing mammalian cells. Biotechnological methods are used to equip these cells to produce viruses - not coronaviruses, however, but harmless vector viruses that cannot make people sick. The vector viruses are genetically modified to carry the genetic blueprint for the spike protein of the covid-19 pathogen SARS-CoV-2. This is critical for the vector viruses to provide a protective response against Covid-19 after vaccination. The vector viruses are eventually "harvested" from the cell culture. After being thoroughly but gently purified, they can be transferred to glass vials in a liquid suitable for vaccination.

The production of messengerRNA (mRNA) vaccines is even different. In the first step, it begins with the multiplication of bacteria, to which small ring-shaped pieces of DNA have previously been inserted by genetic engineering, in large bioreactors. The DNA rings multiply with the bacteria. When the bacteria are then killed, they release the ring-shaped DNA pieces. These are necessary for the production of the actual mRNA. In the next step, highly pure mRNA must be produced from this mix. In a further step, this is then enclosed in liquid in submicroscopic vesicles consisting of nature-identical and artificial lipid-like molecules; these vesicles, called lipid nanoparticles, must not be too small or too large. The finished solution containing the lipid nanoparticles is then filled into glass vials.