vfa and Kearney: Germany needs to reverse trend in pharmaceutical innovation

Germany has some strengths to show in the competition among locations for pharmaceutical R&D, but has nevertheless been falling behind internationally for some years, for example in the area of clinical trials. The study "Pharma-Innovationsstandort Deutschland" (Pharmaceutical Innovation Location Germany) published in July 2023 by the vfa and management consultants Kearney identifies key reasons for this, but also points to measures for reversing the trend. These include a roundtable "Pharma-Innovationsstandort Deutschland" coordinated by the Federal Chancellery or the Federal Ministry of Health.

Studie 'Pharma-Innovationsstandort Deutschland'

How cutting-edge research can be made possible, new therapeutic options secured and Germany's international

competitive position can be strengthened.

The study by vfa and Kearney is available here (PDF). An executive summary of the study is also available in English (PDF).

Study location Germany

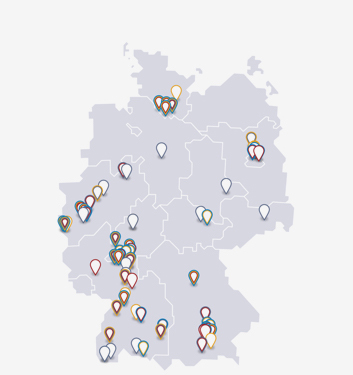

In their analysis, the authors of the study identify major handicaps for organizing clinical trials, access to health data and cooperation with academic research, among other things, as a burden on Germany as a location for innovation. They go into particular detail about the problems in the area of clinical studies, which affect all study sponsors (i.e., study initiators) equally - pharmaceutical companies as well as research institutes and research-based physicians.

In recent years, Germany (once the world's No. 2 after the USA) has been overtaken by a number of countries: the UK, France, Spain and Canada. China is now also far ahead of Germany with almost 7,800 ongoing studies. This is shown in the following chart:

The extent to which Germany falls short of its potential when it comes to study activity and the number of study participants in relation to the number of inhabitants becomes clear. In both cases, Germany ranks far behind other industrialized nations.

Podcast "vfa-Tonspur" on this topic:

The guests are Dr. Doris Henn, responsible for clinical studies in Germany/Austria/Switzerland at AstraZeneca, and Dr. Matthias Meergans, Managing Director of Research and Development at vfa.

And these values threaten to deteriorate further. If no decisive countermeasures are taken, Kearney projects that by 2030, for example, up to 35% fewer clinical trials will be conducted in Germany, and 40% fewer people will participate in trials. This would be a bitter loss, especially for those people in Germany who are hoping for early access to innovative treatment options even before they are approved.

But Germany would also lose out in other respects, because if clinics or doctors' practices participate in studies, this also ensures that more doctors are at home with the latest medical developments and then know how to treat patients with the new drugs from day 1 of their market launch. Particularly with complicated therapies such as CAR T-cell therapies in oncology, this is of enormous value for the provision of care.

And if hardship programs are set up for new drugs that have largely been developed to completion, in which they can also be given to non-study participants who are already in need, often only physicians who already know them from studies would be allowed to prescribe them. And if the obstacles were overcome that today greatly delay or thwart the participation of German hospitals and doctors' practices in studies, the German contribution would help to shorten the development times for new drugs.

What can be done

As part of the study, Kearney evaluated the assessments of 50 experts from the pharmaceutical industry on how they see Germany positioned as an innovation location in terms of relevant factors (actual values) and what performance should be expected from a good location (expected values). This is shown in the following graphic.

The largest discrepancies were then the starting point for developing seven recommendations for action that should be addressed in order to strengthen Germany as an innovation location:

- Systematically reduce bureaucracy in study approvals

- Simplify contracts between medical institutions and study sponsors

- Accelerate study implementation by increasing the number of specialists and improving patient recruitment

- Make an international contribution to the collection of medical research data

- Enable and simplify data access for industrial research

- Promote excellence in science

- Strengthen networking and translational focus

For each of these points, specific measures are identified within the study to achieve the goals.

Dr. Matthias Meergans, co-author and Managing Director of Research & Development at the vfa, summarizes: "Strengthening the innovation location can succeed if research can once again proceed at a competitive pace, companies and universities are given better access to pseudonymized medical care data, and the ecosystem for translating basic research into treatment options for patients is strengthened. To take one example: Even the mandatory introduction of model contracts as a starting point for contract negotiations between pharmaceutical companies and hospitals based on the French model could make a big difference in Germany."